- Key Takeaways

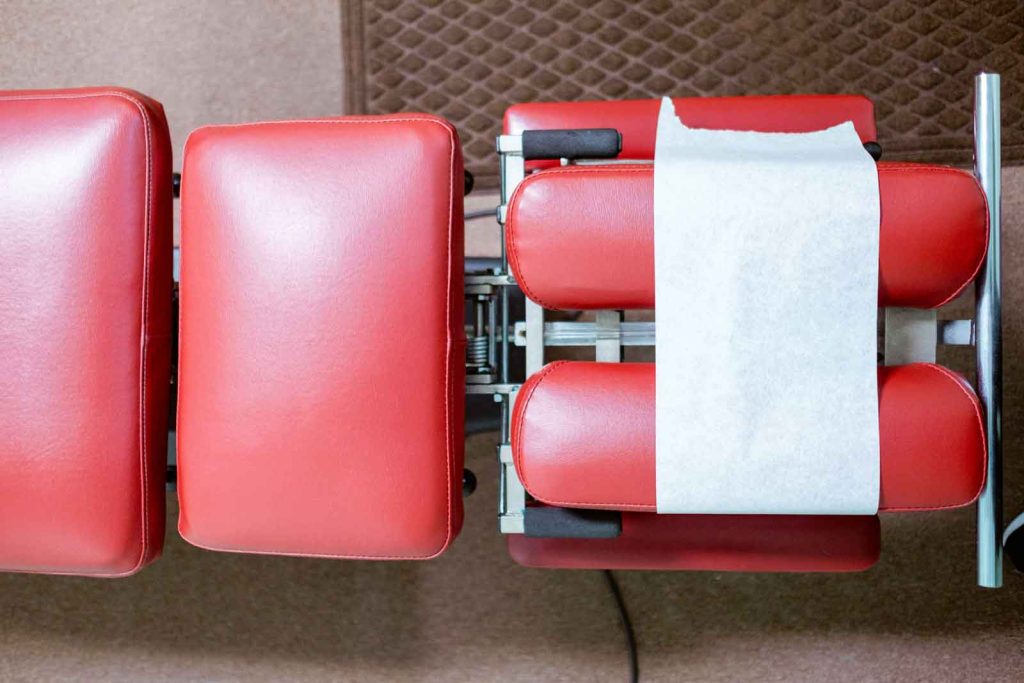

- Navigating Insurance Needs for Your Chiropractic Clinic

- Professional Liability: A Must-Have for Chiropractors

- Managing Risks with Business Owner Policies (BOP)

- Health Plans and Chiropractic Services: Understanding Patient Coverage

- Financial Implications: The Cost of Insurance for Chiropractors

- Secure Your Practice: Acquiring Chiropractor Insurance

- Conclusion

- Frequently Asked Questions

As a chiropractor, precision is key in every aspect and choosing insurance is no exception. Proper insurance safeguards your practice and sets a foundation for your long-term success.

This article is an in-depth guide to insurance for chiropractors. It lists the essential insurance needs, looks at cost-effectiveness, and offers clear advice on getting coverage.

Key Takeaways

- Chiropractors must have essential insurance such as Professional Liability, General Liability, Property, Business Interruption, and Workers’ Compensation to protect their practice from various legal and financial risks.

- A Business Owner’s Policy (BOP) provides a cost-effective insurance solution by combining commercial property and general liability coverages, designed for small to medium-sized chiropractic practices.

- The cost of insurance for chiropractors is influenced by multiple factors like practice size, and location. Getting the right coverage means comparing quotes. You must also understand policies and navigate the application process well.

Navigating Insurance Needs for Your Chiropractic Clinic

Starting a chiropractic clinic without insurance is risky. It’s like walking a tightrope without a balance pole. Insurance protects your chiropractic clinic from unexpected events, guarding against the unforeseen and ensuring that your practice can weather any storm. It also ensures you meet all state requirements. it’s crucial, whether for a lobby slip or state needs.

Let’s delve into the essential insurance policies that form the protective shell around your clinic. Ensure that the only adjustments you have to worry about are those you perform on your patients and the preventive services offered. Also, coverage limits should be considered.

Essential Coverage for Chiropractic Practices

In chiropractic care, each adjustment mixes science and skill, but surprises are possible. Professional Liability insurance is the shield against claims relating to those unexpected events. It safeguards your reputation and finances.

But what about the accidents that could happen in the waiting room or damage to clients’ property? General Liability insurance covers these basic third-party risks. Together, they create a strong defense that shields your chiropractic practice from legal claims and financial risks.

A comprehensive insurance plan is not just a safety net, it’s an essential component of your business strategy. It reduces risks and lets you focus on providing top-notch care.

Property and Business Interruption Insurance

Imagine arriving at your chiropractic clinic after a disaster. It could be a storm or a broken pipe, the damage to your office and state-of-the-art equipment is severe. Property Insurance protects these assets. But what about the lost income during the time it takes to pick up the pieces?

Business Interruption Insurance steps in to provide financial support. This helps your chiropractic practice to recover and stay financially stable.

Customizing these policies to fit your clinic’s unique needs is a cost-effective approach to coverage. It also reassures you that if adversity strikes, your practice will continue.

Workers’ Compensation for Employee Safety

Your team is the backbone of your practice but what happens when one of them gets injured on duty or sustains sports injuries? Professional or general liability insurance won’t cover these incidents.

That is where Workers’ Compensation insurance comes in. It’s not just about doing right by your employees; it’s also about protecting your clinic from the financial implications of work-related injuries or illnesses.

In many states, carrying Workers’ Compensation insurance is not optional, it is mandatory. Neglecting this critical coverage could leave your practice exposed to paying out of pocket for costly medical bills and compensation, a financial burden no chiropractic clinic would want to bear.

Professional Liability: A Must-Have for Chiropractors

Professional Liability insurance shields chiropractors from legal attacks due to mistakes or negligence when providing professional services. In some states, it’s not just about best practices, it is mandatory. Even your property lease could require it. This policy covers legal defense and shields against lawsuit costs.

Insurance is crucial, it covers both finances and well-being. It also covers personal injury claims. This protection represents an investment in the future stability of your practice and helps reduce potential legal costs.

Tailored Malpractice Solutions for Chiropractic Care

Malpractice insurance for chiropractors is like a bespoke suit tailored to fit the unique contours of the torso. It distinguishes itself from general medical malpractice insurance by addressing the specific risks chiropractors face.

However, the devil is in the details. Policy exclusions are the fine print that can make or break your coverage. Understanding them is paramount.

Bundling your Professional Liability Insurance with other policies can be a strategic move. It can potentially lower your overall insurance costs and ensure you’re covered from multiple angles.

Managing Risks with Business Owner Policies (BOP)

The Business Owner’s Policy (BOP) is a beacon of hope for chiropractic businesses navigating the world of risk management. This policy is two-in-one.

It combines commercial property insurance and general liability coverage, creating a tailored insurance package designed specifically with chiropractic practices in mind.

It’s the most economical option for your business. It provides cover against various risks at a lower cost than if you were to purchase separate policies.

Small to medium-sized practices, in particular, find solace in the BOP’s streamlined approach to insurance as it provides the essential needs in one combined, cost-effective package.

Combining Coverage for Comprehensive Protection

The Business Owner Policy (BOP) is like a Swiss Army knife for chiropractors. It is a multi-cover policy that combines commercial property and general liability insurance into one comprehensive package.

This approach not only leads to reduced insurance premiums but also simplifies the management of insurance needs.

With a BOP, you’re not just checking boxes on a list of requirements; you’re fortifying your practice with comprehensive protection that assists with risk management and assures the sustainability of your business.

Health Plans and Chiropractic Services: Understanding Patient Coverage

As a chiropractor, understanding health insurance plans is important. Patient coverage for chiropractic services offers many options with variations in health plans as well as those mandated by states. This provides a wide range of coverage at a chiropractor’s office.

While health plans like the Preferred Provider Organizations (PPO) offer the flexibility of covering services both in and out of the network, others like the House in Multiple Occupancy (HMO) may require referrals and limit coverage to in-network providers.

Medicare Part B, for instance, selectively covers medically required chiropractic services like spinal adjustments, provided they’re performed by Medicare-approved practitioners.

Navigating In-Network Provider Agreements

Your patients need to navigate the maze of in-network and out-of-network providers. This will let them get the full benefits of their health plans.

High Deductible Health Plans (HDHP) and Health Savings Accounts (HSA) add another layer to this mix. They allow patients to pay for chiropractic expenses using pre-tax money. They can do this once they’ve met their plan’s high deductible.

Impact of Patient Deductibles and Copayments

Deductibles and copayments are financial hurdles patients may face before they enjoy the benefits of chiropractic care.

These out-of-pocket costs often need to be paid at the point of service. Understanding these obligations is essential for maintaining a transparent relationship with patients.

As a chiropractor, it’s your responsibility to educate your patients about potential deductible and copayment requirements so there are no surprises when they have to settle the bills.

Financial Implications: The Cost of Insurance for Chiropractors

Let’s talk about money, the lifeblood of any chiropractic practice. The cost of insurance is a significant line item on your balance sheet, with premiums influenced by a multitude of factors such as practice size, location, and services offered.

All insurance carriers do not charge the same price due to varying underwriting practices. It’s the individual assessment methods that determine premium costs.

Estimating Your Insurance Investment

Estimating the cost of insurance requires a careful evaluation of several factors, including experience, type of coverage, and location, all of which play a role in the final premium.

Different underwriting processes reflect each insurer’s unique risks and business philosophy. Comparing rates and coverage through agents, brokers, or carriers is essential for chiropractors who are looking to accurately estimate their insurance costs.

A typical Business Owner Policy may cost about $40 per month or $500 annually for up to $1 million per incident. This provides a ballpark figure for budgeting purposes.

Secure Your Practice: Acquiring Chiropractor Insurance

Securing the right insurance for your chiropractic practice is a process that requires diligence and attention to detail. Comparing quotes from top providers is a smart way to save money and ensure that you’re getting the best value for your money.

Whether you go through an agent or broker, an insurance program, or directly with an insurance carrier, the options are many, and each has its own benefits and drawbacks.

Choosing the Right Insurance Provider

The search for the right insurance provider is a vital process for your practice. Peer reviews can be illuminating, shedding light on the reputation and suitability of providers in the chiropractic industry.

A balance must be found between comprehensive coverage and cost-effectiveness by comparing multiple insurance options.

Joining professional associations could also be a good move, as they often offer discounted rates on malpractice insurance. Don’t just skim the policy documents; read them thoroughly to avoid hidden costs that may catch you off guard.

Simplifying the Application Process

The application process for insurance doesn’t have to be a labyrinth of paperwork. Embracing the use of standard electronic claim forms, which are now utilized by over 95% of health plans and providers, can streamline the submission process.

Verifying insurance eligibility before each appointment and ensuring accurate data entry can help avoid the frustration of claim denials.

Pre-authorization for chiropractic claims is another crucial step that should not be overlooked as it may be the difference between a claim being accepted or denied. Remember to keep an eye on filing deadlines and track submitted claims as these are key to a smooth reimbursement process.

Conclusion

Insurance is the guardian of your chiropractic practice. It provides a safety net that allows you to focus on caring for your patients. From the protection of malpractice insurance to the comprehensive Business Owner Policy, each coverage option plays a vital role in securing your clinic’s future. Remember, investing in the right insurance is not just a regulatory requirement; it’s an investment in peace of mind and business continuity. Take the steps to protect your practice today, and rest assured that you’re covered for whatever tomorrow may bring.

Frequently Asked Questions

Is Professional Liability insurance legally required for chiropractors?

Professional Liability insurance may be a legal requirement for chiropractors in some states and it may be necessary to meet the terms of a property lease. It protects against legal costs of mistakes or negligence while providing professional services. It’s important to check the specific requirements for your state.

Can a Business Owner’s Policy (BOP) save me money on insurance?

A business owner’s policy (BOP) can save you money on insurance by combining property and liability coverage in a cost-effective package. This provides comprehensive protection for your business.

How does patient coverage vary in health plans?

Patient coverage for chiropractic services varies between health plans. PPOs offer more flexibility for in-network and out-of-network services, while HMOs limit coverage to in-network providers and require referrals.

What factors influence the cost of malpractice insurance for chiropractors?

The cost of malpractice insurance for chiropractors is influenced by factors such as experience, coverage options, location, and specific underwriting guidelines of the insurance company.

What is the role of patient deductibles and copayments in chiropractic care?

Chiropractic patients are responsible for paying deductibles and co-payments before insurance kicks in. Clear communication of these costs to patients is essential for transparency.